This is my approach of getting a simple first overview of what the Stock Market really is. It works as a starting point and as a reminder along the way. Just as with every other post, I plan on adding and editing this as my knowledge deepens. Let’s dive right into it!

Table Of Content

- Companies & Stocks

- Market Capitalization

- Stock Exchanges

- Market Opening Hours

- Sectors & Industries

- Stock Indices

- Recap (next)

Companies & Stocks

There are currently ~ 359 million companies worldwide1. Most of these companies are “private” which means they won’t offer stocks. Those who will are “public” and to understand their motive, it’s important to first understand what a company actually is.

What is a company?

Usually it all starts with one person that wants to solve a bigger problem for many other people, in the hope that each of these other people will pay him for it. This is the role of an entrepreneur. Since his mission requires him to create a business that is meant to work systematically and also shouldn’t rely on him personally, he registers a private company. His customers aren’t dealing with him personally anymore, but rather with what can be viewed as an “artificial person”, a legal entity that is meant to exist even in the demise of its original founder. Imagining this artificial person becomes way easier when viewing it from a perspective of branding.

Branding helps visualising what a company is:

| Characteristic | Human | Brand |

|---|---|---|

| Name | Bob | Nike |

| Appearance | Pale skin, blue eyes, ginger hair, tall, slightly overweight | High energy, strong contrast colors (black, white, red, orange) |

| Most recognizable | Birthmark on right cheek that resembles the shape of Italy | The Nike Swoosh |

| Tone | Laid back, easy going, friendly | Bold, inspirational, motivational |

| Motto | “Sip happens: make it a good one” | “Just Do It” |

| Mission | To become the best version of himself and be helpful to others | To bring inspiration and inovation to every athlete in the world |

| Values | Respect, honesty, tradition | Excellence, empowerment, teamwork, diversity |

| Likes | Sports, Beer, Gardening | Athletes, Champions, Sports, Winning |

The founder has now created this artifical person, has purposefully imparted it with core attributes that customers can relate to and has given it a (hopefully catchy) name, so it will properly be recognized and easily distinguished from other artifical people and one day (also hopefully) become very well known to the public and rise to popularity!

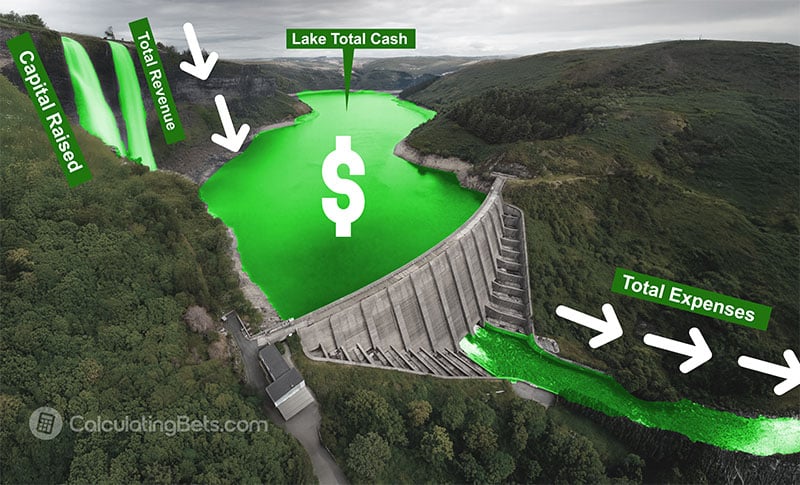

Under its hood every company is a rather complex system consisting of employees, finances, research and development, quality assurance, marketing, sales and much more. In it’s core, however, it functions pretty much like a dam: Water goes into it from one side and out of the other, while the goal is to keep a considerable amount in an ever growing reservoir in its middle. Simply replace water with money and you get a very simplificated visualization of a basic business’ design.

In order for the company to not only keeping but also growing it’s business, it is of utmost importance, that the water flow never stops. Instead it’s viable that it constantly increases. Think about this the next time you are researching a company’s “cash flow”.

Every company needs money and the more the better. Sometimes taking on debt is alright, but in the long run money should come from generating revenue, asset appreciation or…

Raising capital from investors

Pretty much every country has private companies and most of them could theoretically become public, which means issuing shares and becoming a tradeable stock. These shares can than be bought by institutional or retail investors, resulting in an increase in capital for the company (check out “capital raised” in the graphic above).

Initial Public Offering (IPO)

The company approaches one (or more) investment banks, who will transition the formerly private company into a public company. At an IPO not the market but the investment banks will decide upon the initial price for a newly available stock. They will also approach first potential buyers (institutional investors) and thus create a very first market for these shares (initial sale).

To put things in perspective: Between 2015-2025 there were an average of 100-200 IPOs per month. Of course this can vary given the economic situation, investor sentiment and so on. You can check out upcoming IPOs on the Nasdaq IPO calendar.

Due to the investment banks involvement, the price is usually too high and will dip right after the IPO until the market decides upon a stock’s worth. This is why retail investors like us shouldn’t buy stocks all too close to their Initial Public Offerings.

Just because a company issues stock doesn’t necessarily mean the shares are publicly available for trading! For example, right at an IPO there are usually ‘restricted shares’ that are often held by founders, employees or early investors and are subject to lock-up periods (up to 180 days). There are also dual-class share structures where one class of shares is publicly tradable (GOOGL Class A), while another class is restricted to insiders (GOOGL Class B)2. However, this is not all too common. The amount of shares that is available to the public will also be referenced to as “float“.

Small Cap, Mid Cap, Large Cap

It’s a common practice to group companies by their “Cap”, which is short for “Market Capitalization”. This is the total market value of a company’s outstanding shares (total shares X price per share). Outstanding as in “available to or held by the public”. For example, the Market Cap of Coca Cola is currently ~ $266.14B3.

Market Cap = 4,326,691,783 shares X $61.65 = $266.14B

The “Caps” visualized

While Small Caps can be as small as $300 million, Mega Caps are greater than $200 billion.

$300M – $2B

$2B – $10B

> $10B

> $200B

* Mega Cap: There are currently only about 50 companies globally that fit that category (Of course the “Mag 7” and then some others)

Stock Exchanges

There are currently 193 sovereign countries in our world as recognized by the United Nations4.

Stock exchanges exist in about 42 of these countries5, trading a total of ~ 60,000 companies worldwide6. Not all stocks can be traded across every foreign country. The U.S. stock market is the most important, for one because of the country’s large economy7 but also because it attracts significant capital from ivestors all over the world.

The New York Stock Exchange (NYSE) is the largest stock exchange by market cap (total value of tradable stocks). It is dating back to 18178 and has always been located on the city’s (infamous) Wall Street (check it out in Google Street View). The world’s very first one was the Amsterdam Stock Exchange, which is dating back to 1602.

Private and public companies in comparison

359M

60k

7k

Out of 359M companies worldwide only ~ 60k are public and out of those only ~ 7k can be traded on US Stock Exchanges 9 (way less than 0,1% of total global companies).

Market Opening Hours

As with any business, Stock Exchanges do have regular opening hours. Why is this important?While Small Caps can be as small as $300 million, Mega Caps are greater than $200 billion. Because opening hours can directly lead to spikes in the increase or decrease of a stock.

| Trading Hours | From | To | Important |

|---|---|---|---|

| Regular (Major U.S. Stock Exchanges) | 9:30 AM (ET) | 4:00 PM (ET) | Most liquidid, lowest volatility, supports all order types, main market events take place |

| Premarket | 4:00 AM (ET) | 9:30 PM (ET) | Availability depends on broker, mostly institutional trading |

| After-Hours | 4:00 PM (ET) | 8:00 PM (ET) | Lower volume, higher volatility, institutional and some retail |

Global exchanges will have varying opening times.

Premarket is primarly used for reacting to overnight news, earnings reports or geopolitical events, before the market opens.

After-Hours is more for trading earnings reports that have only been released after the market closes and reacting to late breaking news.

“Men do not feel the same toward the world on Monday as they do on Wednesday or Saturday, and this even affects their attitude toward buying and selling securities. Cold fact is that Monday is the worst day of the week, in the longrun, for selling and the best day for buying. Moreover, declines came more often on Monday than on any other day.”

Sectors & Industries

One thing is for certain: not all companies are alike. It might be obvious to some that you can’t compare Nike to Alphabet, yet comparing stocks and their metrics is an important part of stock trading. To make research and asset management easier, there are certain standard industry definitions that professionals and retail investors agree upon.

The Global Industry Classification Standard (GICS)

Developed in 1999 by S&P Dow Jones Indices and MSCI, the GICS methodology is the official classification of companies into sectors, industry groups, industries and sub-industries.

- 11 sectors

- 24 Industry Groups

- 69 Industries

- 158 Sub-Industries

The GICS is not a static data set but undergoes periodic revisions to reflect the evolving global economy. The introduction of new sub-industries, reclassification or discontinuation of existing one happens periodically10.

Video: Cathie Wood on how GICS had to split “Technology” into “Communication Services” 11.

It’a also important to understand that each sector has its own growth rate 12.

Some sources may alter the official classification for various reasons as simple as readability. Personally, I like TradingView.com not necessarily for their own division approach, but for the way they’ll let you filter data.

Another valid (yet unofficial) classification approach: 20 Sectors including 129 industries

| Commercial Services | Communications | Consumer Durables | Consumer Non-Durables | Consumer Services | Distributionn Services | Electronic Technology | Energy Minerals | Finance | Health Services | Health Technology | Industrial Services | Miscellaneous | Non-Energy Minerals | Process Industries | Producer Manufacturing | Retail Trade | Technology Services | Transportation | Utilities |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| View industry details | View industry details | View industry details | View industry details | View industry details | View industry details | View industry details | View industry details | View industry details | View industry details | View industry details | View industry details | View industry details | View industry details | View industry details | View industry details | View industry details | View industry details | View industry details | View industry details |

| View sector stocks | View sector stocks | View sector stocks | View sector stocks | View sector stocks | View sector stocks | View sector stocks | View sector stocks | View sector stocks | View sector stocks | View sector stocks | View sector stocks | View sector stocks | View sector stocks | View sector stocks | View sector stocks | View sector stocks | View sector stocks | View sector stocks | View sector stocks |

| Personnel Services | Wireless Telecommunications | Other Consumer Specialties | Food: Speacialty/Candy | Publishing: Newspapers | Medical Distributors | Aerospace & Defense | Integrated Oil | Financial Conglomerates | Hospital/Nursing Management | Biotechnology | Oil & Gas Pipelines | Investment Trusts/Mutual Funds | Precious Metals | Industrial Specialties | Office Equipment/Supplies | Food Retail | Data Processing Services | Other Transportation | Electric Utilities |

| Financial Publishing/Services | Major Telecommunications | Recreational Products | Food: Mahor Diversified | Restaurants | Food Distributors | Computer Peripherals | Oil & Gas Production | Life/Health Insurance | Services to the Health Industry | Pharmaceuticals: Other | Environmental Services | Miscellaneous | Steel | Chemicals: Agricultural | Auto Parts: OEM | Department Stores | Packaged Software | Marine Shipping | Alternative Power Generation |

| Advertising/Marketing Services | Specialty Telecommunications | Automotive Aftermarket | Beverages: Non-Alcoholic | Other Consumer Services | Electronic Distributors | Computer Communications | Coal | Insurance Brokers/Services | Managed Health Care | Medical Specialties | Oilfield Services/Equipment | Other Metals/Minerals | Chemicals: Specialty | Electrical Products | Internet Retail | Internet Software/Services | Air Freight/Couriers | Gas Distributors | |

| Commercial Printing/Forms | Specialty Telecommunications | Homebuilding | Tobacco | Cable/Satellite TV | Wholesale Distributors | Computer Processing Hardware | Oil Refining/Marketing | Major Banks | Medical/Nursing Services | Pharmaceuticals: Major | Engineering & Construction | Aluminum | Textiles | Miscellaneous Manufacturing | Apparel/Footwear Retail | Information Technology Services | Airlines | Water Utilities | |

| Miscellaneous Commercial Services | Home Furnishings | Beverages: Alcoholic | Media Conglomerates | Electronic Equipment/Instruments | Investment Banks/Brokers | Pharmaceuticals: Generic | Contract Drilling | Forest Products | Containers/Packaging | Metal Fabrication | Specialty Stores | Trucking | |||||||

| Motor Vehicles | Apparel/Footwear | Broadcasting | Electronic Components | Real Estate Investment Trusts | Construction Materials | Pulp & Paper | Industrial Machinery | Drugstore Chains | Railroads | ||||||||||

| Tools & Hardware | Consumer Sundries | Movies/Entertainment | Semiconductors | Finance/Rental/Leasing | Chemicals: Major Diversified | Industrial Conglomerates | Catalog/Specialty Distribution | ||||||||||||

| Electronics/Appliances | Food: Meat/Fish/Dairy | Publishing: Books/Magazines | Telecommunications Equipment | Investment Managers | Agricultural Commodities/Milling | Building Products | Electronics/Appliance Stores | ||||||||||||

| Hotels/Resorts/Cruise lines | Electronic Production Equipment | Savings Banks | Trucks/Construction/Farm Machinery | Home Improvement Chains | |||||||||||||||

| Casinos/Gaming | Property/Casualty Insurance | Discount Stores | |||||||||||||||||

| Household/Personal Care | Multi-Line Insurance | ||||||||||||||||||

| Real Estate Development | |||||||||||||||||||

| Regional Banks | |||||||||||||||||||

| Specialty Insurance |

Stock Indices

An index is a visualization of the performance of a stock market over time. Indices can illustrate a whole stock market, yet more frequently, they are used to diplaying subsets of stock markets.

Subsets of stock markets

An index can show a subset of a stock market like a certain sector, only a particular industry or a whole nother grouping of individual stocks. The S&P 500 for example represents the performance of the 500 largest U.S. companies.

There are ~31 commonly used indices in the U.S. alone13, as well as several dozen more on a global scale.

Example: The Russel 2000 index

Russel 2000 increases while S&P500 decreases? Maybe it’s time to start investing into smaller caps14.

Recap

Private companies “go public” to raise capital. Out of 359 million private companies globally we can trade the stocks of about 7,000 on US Stock Exchanges. Opening Hours matter. Generally Stocks are categorized into Sectors, Industries and Sub-Industries. The official standard is GICS, but other approach might also come in handy. Alternatively stocks can be grouped by their “Market Capitalization”, the amount of money their total shares are worth. They usually start at around 300 million but can go to way above 200 billion US dollar (which is true for only about 50 out of 7,000 companies). To better visualize the performance of certain groupings of individual stocks we look at indices, especially the 31 commonly used in the US (e.g.: S&P 500, Russel 2000, etc.).

References

- https://www.statista.com/statistics/1260686/global-companies/

- https://www.investopedia.com/ask/answers/052615/whats-difference-between-googles-goog-and-googl-stock-tickers.asp

- https://finance.yahoo.com/quote/KO/

- https://en.wikipedia.org/wiki/Member_states_of_the_United_Nations

- https://en.wikipedia.org/wiki/Category:Stock_exchanges_by_country

- https://focus.world-exchanges.org/articles/number-listed-companies

- https://en.wikipedia.org/wiki/Stock_market_index#:~:text=A%20comparison%20of%20three%20major,Average%2C%20and%20S%26P%20500%20Index.

- https://de.wikipedia.org/wiki/New_York_Stock_Exchange

- https://www.nasdaq.com/market-activity/stocks/screener?page=1&rows_per_page=100

- https://www.msci.com/documents/1296102/29559863/GICS_Structure_Change_Doc_31_March_2022.pdf/d2437e6d-9ae5-0bad-c758-9e2a5f917a69?t=1648760449996

- https://youtu.be/Cz2nZMC4rU4?t=160

- https://www.tradingview.com/markets/stocks-usa/sectorandindustry-sector/

- https://en.wikipedia.org/wiki/List_of_stock_market_indices

- https://www.reddit.com/r/CountryDumb/comments/1h94by4/qa_how_will_a_newbie_know_when_to_buy/